does tennessee have inheritance tax

Next year it will. The inheritance tax is paid out of the estate by the executor administrator or trustee.

Tennessee Phases Out Inheritance Tax And Repeals Gift Tax Wealth Management

It allows every Tennessee resident to reduce the taxable part of their estate gifting it away to the heirs 16000 per person every year.

. All inheritance are exempt in the State of. Maryland and New Jersey have both. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance.

1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015. The national debate about charging federal estate taxes has revealed some misconceptions about Tennessees laws.

For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to. The legislature set forth an exemption schedule for the tax with incremental increases. What is the state of Tennessee inheritance tax rate.

There is no federal inheritance tax but there is a federal estate tax. The inheritance tax is paid. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

As of December 31 2015 the inheritance tax was eliminated in Tennessee. Those who handle your estate following your death. Up to 25 cash back Update.

Only those estates that are valued 5 million. Many Tennesseans are surprised to hear that the state does have an. There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in.

Not many Tennessee estates have to pay the estate tax because the state offers a generous exemption for deaths occurring in 2015. Tennessee does not have an estate tax. Inheritance Tax in Tennessee.

Today the Tennessee inheritance tax exemption for 2014 is raised to 200000000. An inheritance tax is a tax on the property you receive from the decedent. Tennessee is an inheritance tax-free state.

The inheritance and estate taxes wont be a. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. It has no inheritance tax nor does it have a gift tax.

In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. Fourteen states and the District of Columbia impose an estate tax while six states have an inheritance tax. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

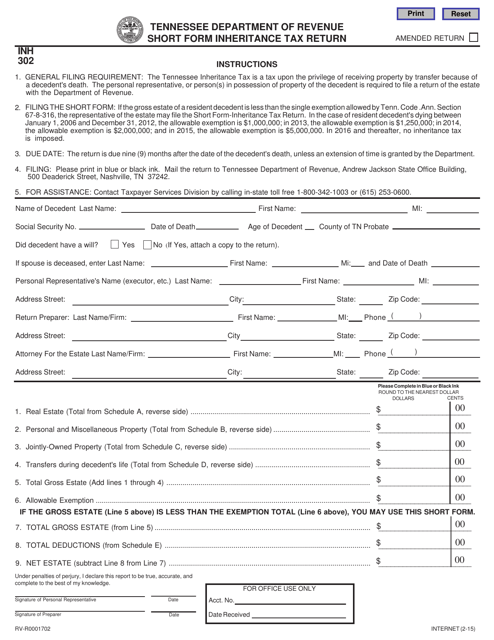

Only seven states impose and inheritance tax. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. Tennessee is an inheritance tax and estate tax-free state.

For deaths occurring in 2016 or later. Does Tennessee Have an Inheritance Tax or Estate tax. State inheritance tax rates range from 1 up to 16.

Tennessee and Federal Estate Tax Exemptions Raised Today for 2014. IT-12 - Inheritance Tax Deduction - Real Property Sale Expenses. IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State.

There are NO Tennessee Inheritance Tax. The inheritance tax is levied on an estate. However there are additional tax returns that heirs and survivors must resolve for their deceased family members.

Even though this is good news its not really that surprising. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. IT-11 - Inheritance Tax Deductions.

If the value of the gross estate is below the exemption allowed for the year of death. Tennessee does not have an inheritance tax either. It is one of 38 states with no estate tax.

A J Green House In Nolensville Tn Watercolor And Gouache Ousley Chris Art Original Fine Art Fine Art

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

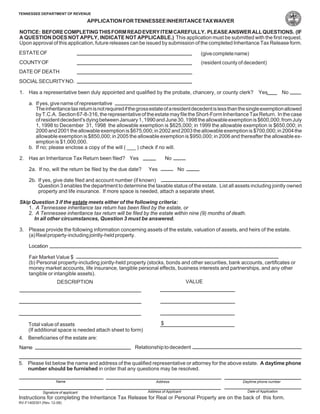

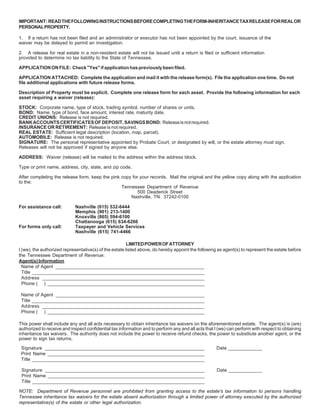

Tennessee Health Legal And End Of Life Resources Everplans

A Guide To Tennessee Inheritance And Estate Taxes

Tennessee Inheritance Laws What You Should Know Smartasset

The 35 Fastest Growing Cities In America City Houses In America Murfreesboro Tennessee

A Guide To Tennessee Inheritance And Estate Taxes

What You Need To Know About Tennessee Will Laws

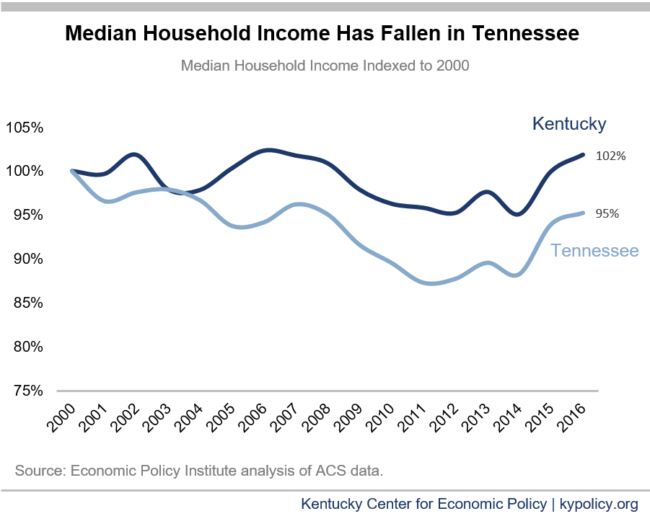

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

Tennessee Retirement Tax Friendliness Smartasset

January 1st Enactments Tennessee Senate Republican Caucus

Tennessee Inheritance Laws What You Should Know Smartasset

How To Get A Marriage License In Tennessee Zola Expert Wedding Advice

Historical Tennessee Tax Policy Information Ballotpedia